One Quote

One Quote is a unified tool designed to consolidate five separate loan submission processes into a single, streamlined user experience. By simplifying interactions and standardizing workflows across multiple financial products, One Quote significantly reduces submission time and enhances overall consistency and efficiency.

Product Overview

Objective

To design and deliver a unified platform that simplifies loan product discovery, streamlines the application process, and enhances collaboration between borrowers, loan officers, and relationship managers—ultimately improving efficiency, accuracy, and user experience across all lending touchpoints, with a goal of increasing loan submissions by 20%.

Problem Statement

Borrowers, loan officers, and relationship managers currently rely on fragmented products and inconsistent processes that vary by loan type—resulting in delays, miscommunication, and a disjointed customer experience. There is a clear need for a unified, user-friendly platform that streamlines product discovery, submission, and collaboration—enhancing speed, accuracy, and consistency across the entire lending journey.

Double Diamond Design Process

The Double Diamond Design Process is a four-phase framework that guides teams through problem-solving with a human-centered approach. It consists of two diamonds: the first focuses on understanding the problem through discovery and definition, while the second centers on solving it through development and delivery. By alternating between divergent thinking (exploring many possibilities) and convergent thinking (narrowing down to the best solution), the process ensures thorough research, clear problem definition, creative ideation, and effective implementation.

I gradually introduced a skeletal framework of the process throughout the project. Given the strong resistance to new methodologies—often seen as disruptive or burdensome—I integrated the approach subtly and incrementally. This allowed me to gather valuable insights and guide the team through key phases without disrupting workflows or encountering pushback.

Discover & Define

Before building the product, it's essential to validate that a real problem exists and deeply understand the target users—their context, frustrations, needs, and pain points. This includes exploring how they currently address the problem, identifying the strengths and limitations of existing solutions, and uncovering their vision of an ideal experience. These insights ensure the product is grounded in real user needs and designed to deliver meaningful value.

We validated the existence of a real user problem by researching current workflows, identifying pain points, and uncovering unmet needs. Through this, we gained a deep understanding of the user context by exploring their goals, frustrations, and expectations for an ideal solution. Additionally, we assessed existing tools and approaches to identify clear gaps and opportunities, paving the way for a more effective and user-centered product.

Key Takeways

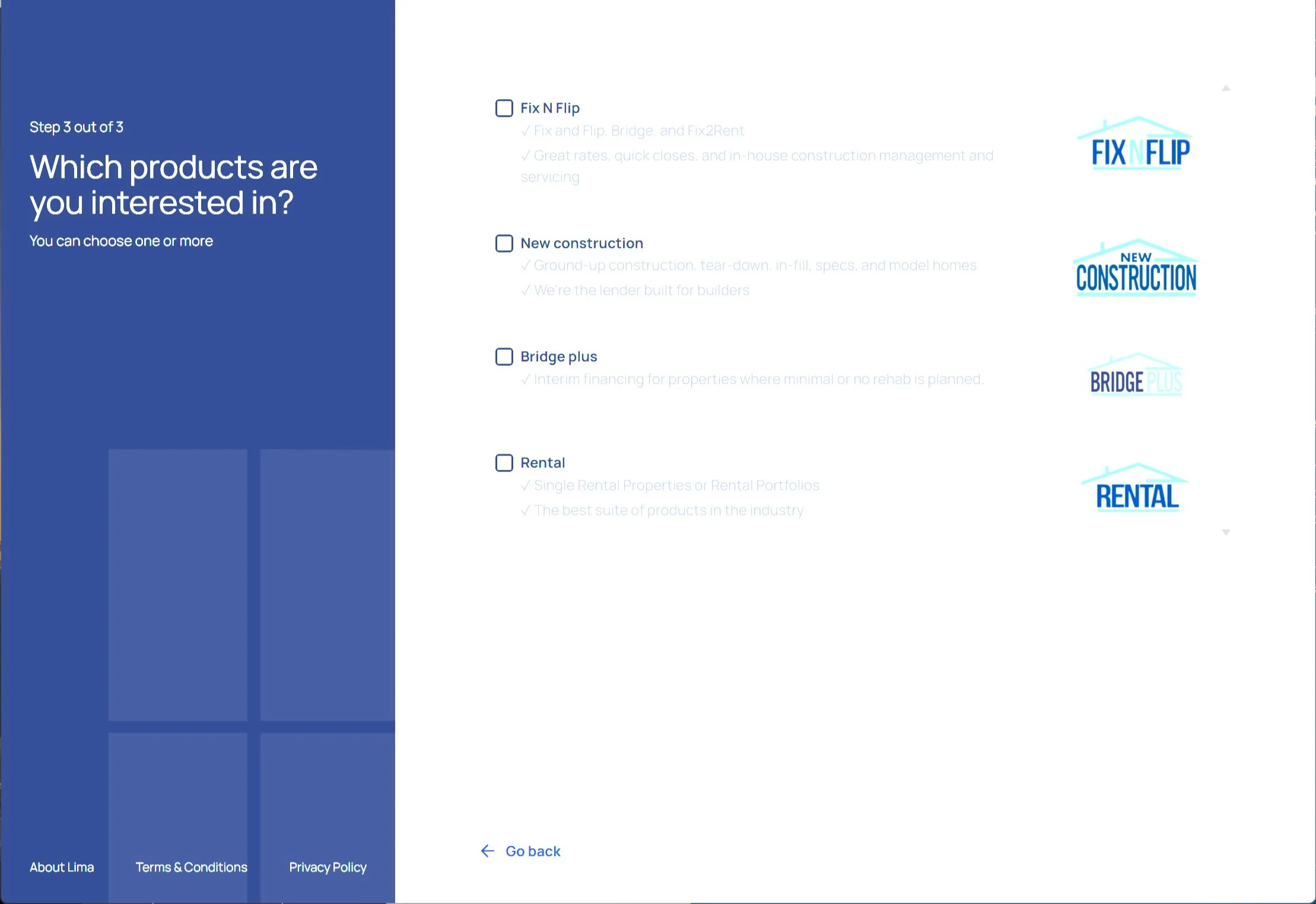

The product line is divided into two distinct types: Bridge loans, which are short-term solutions designed to cover immediate financing needs, and Term loans, which are long-term loans geared toward rental properties and stable income investments.

Bridge Loans are currently offered for Fix & Flip, Ground-Up Construction, and Stabilized Properties.

Term Loans are available as Single Property Rental and Rental Portfolio options.

The disconnected experience between product types led to user confusion and frustration, making it difficult to navigate and complete tasks efficiently.

Because of the industry's unique nature, standardized terminology and processes don’t exist at scale, resulting in inconsistent user experiences and increased learning curves across platforms.

Surveys

We designed and deployed targeted surveys to collect both quantitative and qualitative user feedback. This process validated assumptions, revealed key user needs and pain points, and provided data-driven insights that directly informed product decisions and feature prioritization.

We designed and conducted targeted surveys to gather both quantitative and qualitative feedback, which validated our assumptions and revealed users’ core needs, behaviors, and pain points; these insights directly informed product strategy and helped us prioritize features according to real user input.

Key Takeways

Speed and efficiency in funding emerged as a recurring theme in the survey results. Users frequently emphasized that knowing when a loan could be funded was a key factor in choosing a lender, often outweighing other considerations.

Familiarity and ease of submitting potential loans ranked as the second most requested feature. Users valued a straightforward submission process, especially when paired with the flexibility to choose a lender.

A major pain point was the lack of clear guidance or standardized processes. For example, when a borrower is missing a required file, there’s no defined protocol for communication or issue resolution—leaving both the loan officer and borrower uncertain about next steps and causing delays in submission and approval.

User Personas

User personas for the Comparison Analytics Tool were developed to represent the key segments of our target audience, including underwriters, lenders, and real estate professionals. These personas were created based on insights gathered from interviews, surveys, and user research, and reflect the typical goals, behaviors, pain points, and workflows of our users.

Amanda – The Retail Borrower

Age: 34

Occupation: Small Business Owner

Tech Comfort: Moderate

Goals: Quickly find the best loan offer, understand the terms clearly, and track your application in real time.

Frustrations: Confusing loan terms, repeated paperwork, and long wait times before receiving an offer.

Needs:

Clear loan comparisons, easy application steps, and timely status updates.

Jordan – The Loan Originator

Age: 45

Occupation: Senior Loan Officer at a Mid-Size Lending Firm

Tech Comfort: High

Goals: Handle multiple applications smoothly, deliver fast tailored quotes, and reduce delays by anticipating document needs.

Frustrations: Manual data entry on various platforms, delays from incomplete submissions, and repeated quote comparisons.

Needs : Streamlined client intake, real-time quote comparisons, and mobile access for on-the-go responsiveness.

Eric – The Relationship Manager

Age: 38

Occupation: Client Relationship Manager at Roc Capital

Tech Comfort: High

Goals: Deliver personalized support, build trust through transparency and speed, and coordinate smoothly among all stakeholders.

Frustrations: Poor team communication, no centralized client activity view, and trouble tracking loan and investor progress.

Needs: Clear deal status, centralized relationship dashboard, and tools for team collaboration and client management.

Competitor analysis

The competitor analysis for One Quote focused on platforms supporting real estate investors, borrowers, and lending professionals with loan comparisons, rate shopping, and application management. Current solutions are fragmented—users often rely on a combination of lender websites, manual quote sheets, broker emails, and internal tools to evaluate financing options. This disjointed process leads to delays, inconsistent information, and a lack of transparency. Platforms like LendingTree, Bankrate, and traditional loan origination systems offer some functionality but fall short in providing a seamless, real-time, borrower-facing experience. This revealed a clear market gap for One Quote: a unified, user-friendly platform that simplifies loan discovery, comparison, and submission into a single streamlined workflow—empowering users with faster decisions, better visibility, and reduced friction across the borrowing experience.

Roc Capital traditionally does not lend directly to borrowers. Instead, it uses a table funding model, partnering with third-party Loan Originators who interface with borrowers. Roc serves as the capital provider and supports the lending process by offering white-labeled portals, operational infrastructure, and back-end support.

However, in recent years, Roc has expanded its capabilities by acquiring Civic Financial and Finance of America, enabling a direct-to-borrower lending model alongside its existing table funding operations.

Key Takeways

Kiavi is one of our primary direct competitors, especially in the retail direct-to-borrower space. They are performing strongly and are often the lender we’re most frequently compared to.

Their user experience is cleaner, with faster loan funding and a more seamless digital journey for borrowers compared to our current portal.

Their product range is comparable to ours but presented in a way that’s clearer and easier to understand.

RCN Capital is another direct competitor in the table funding space, performing strongly among third-party loan originators.

While their digital experience for third-party originators is limited, they offer a broader product range than Roc.

RCN does offer flexible underwriting for niche deals, backed by reliable funding and service

Lima One Capital is another key competitor to Roc in the retail direct-to-borrower space, with the added advantage of funding in certain states where Roc does not currently operate.

Lima One offer a full product suite paired with national reach, and a trusted investor brand.

Processing times tend to be longer, and the platform is less streamlined and user-friendly.

Jobs to be Done

he Jobs to Be Done framework revealed that users—borrowers, loan originators, and relationship managers—need a fast, clear, and reliable way to compare loan options, manage applications, and maintain transparency throughout the lending process. One Quote supports these jobs by simplifying workflows through real-time rate comparisons, centralized communication, and an intuitive, mobile-friendly interface that reduces friction and accelerates decision-making.

" Real estate investors, borrowers, and lenders need a fast, transparent way to compare loan offers and submit applications for confident, hassle-free decisions.”

Understand Circumstances

Identify the specific challenges users face when navigating fragmented loan comparison and application processes.

Explore the context in which users make financing decisions, including time constraints, financial literacy, and platform access.

Examine existing tools and workarounds users rely on, highlighting pain points, inefficiencies, and missed opportunities.

Identify Hiring Criteria

Determine what key features or capabilities users look for when choosing a loan comparison or application platform.

Understand the factors that build user confidence in adopting a new tool—such as reliability, transparency, or professional recommendations.

Identify the emotional or practical triggers that cause users to “hire” One Quote over other tools, like frustration with manual processes or the need for faster approvals.

Define Success Criteria

Measure how effectively the platform helps users secure the best loan option with minimal effort and confusion.

Track improvements in speed, accuracy, and transparency across the loan comparison and application process.

Assess user satisfaction based on reduced friction, increased confidence in decision-making, and a more streamlined borrower experience.

Develop & Deliver

The development and delivery of One Quote focused on creating a seamless, intuitive experience that helps borrowers, loan officers, and relationship managers make faster, more accurate loan decisions. We began by organizing features through Card Sort to clarify priorities and align development with user needs. User Journey Mapping defined the app’s structure and flow for logical navigation, while wireframes established the foundational layout for early feedback and iterative improvements. Multiple rounds of user testing validated the design, uncovered pain points, and refined the interface before final development.

Feature Set (Card Sort)

Card Sort is a process where features are grouped into categories and ranked by importance once goals and tasks are clear. This helps prioritize development by identifying which features to build first and which can be added in later iterations.

Streamlined application workflow that consolidates document uploads, borrower data, and submission tracking in one interface.

Key Take Aways

Using AI and automation, user-enabled instant loan quotes.

Defining common intake processes—credit, background checks, and property details—across all five product types.

Real-time loan approvals and the ability to submit customized terms for review—accelerating decision-making and enhancing deal flexibility.

Key Take Aways

Introduction of Insta-Quote, an AI-based algorithm for real-time loan approvals.

Enable users to adjust Insta-Quote terms to create and submit counteroffers.

Integrated communication tools that enable borrowers, loan originators, and relationship managers to collaborate and stay aligned throughout the process.

Key Take Aways

Rules-based touchpoints via email, text, or chat designed to keep users informed without overwhelming them.

Establishing common language and standardized verbiage throughout the product.

User Journey Map (flow)

User Journey Mapping is an early ideation step that outlines the application’s workflow across different sections. It helps improve clarity for future development phases and remains adaptable as the design evolves.

Base journey maps were created, with each user persona’s journey varying by user type. In total, 15 user journey maps were developed.

Define the overall architecture and structure by identifying all the various product types and their permutations.

Key Take Aways

Product types are divided into two distinct categories: Bridge and Term, enabling separate workflows tailored to each category.

The introduction of AI automation allows users to instantly receive an Insta-Quote for their selected loan product, based on their credit, background, and subject property details.

Group features into clear, logical sections to guide the roadmap and streamline development.

Key Take Aways

The general flow for all five product types is organized into three main stages of the loan submission process: gathering personal information, collecting subject property details, and generating an Insta-Quote.

On the flip side, this process also reveals what happens during the loan submission journey, providing clear transparency to the user about the current status and progress of their loan.

Define the hierarchy and prioritize each section to focus on the MVP and subsequent releases, guided by data insights.

Key Take Aways

Implementing AI automation became a top priority for the MVP to deliver more accurate loan quotes and significantly accelerate the speed of funding.

Prioritizing consistent terminology and familiar interface elements was key to enhancing the user experience.

Concept Design

Before beginning the design, guidelines were established to ensure white-labeling capabilities and a consistent visual identity aligned with Material Design principles, alongside the gradual introduction of the new global design system. This approach guaranteed the platform would be modern and user-friendly, while also scalable and easily customizable for various brands and clients.

Key Takeways

Gradual implementation of Roc’s Global Design System, built on shadcn/UI, ensured consistency and scalability across the platform while maintaining the white-labeling concept.

Standardization of form fields, their placement, and overall structure helped create a more intuitive and cohesive user experience, establishing a consistent framework to be used across all products moving forward.

The initial rollout will be deployed for Roc’s two internal brands, CIVIC and Finance of America.

Prototyping

This 'Prototyping' section showcases the initial visual and structural framework of the app, serving as a foundation for detailed design, user testing, and development planning. Since I was the sole designer on the project, I was able to address UX issues in real time—working through wireframing, prototyping, and visual design simultaneously. This integrated approach allowed for faster iteration, tighter alignment between functionality and design, and a more efficient path from concept to execution.

Key Takeways

This was the first project to utilize the Global Design System, setting patterns and rules that will be applied to future projects.

By this stage in the growth of design team was still a relatively new concept at Roc360, and many team members found it challenging to interpret traditional wireframes. To address this, I presented nearly finished prototypes as test-bed wireframes, which made it easier for stakeholders to grasp the design intent and offer more meaningful feedback.

This project marked Roc’s first direct approach to soliciting retail business, so delivering a great user experience was essential.

User Testing

As prototypes evolved, the workflow became increasingly clear, enabling continuous refinement and enhancement. This process produced a polished prototype that supported multiple user journeys for usability testing.

Key Takeways

Real customers were selected for user testing, alongside participants recruited through Userlytics.

The most significant feedback was that the new system is "miles better" than the current loan submission process, with many users asking, “Can I do this on my phone?”

Outcomes

The rollout of One Quote led to measurable improvements in loan submission efficiency, user satisfaction, and internal alignment. By automating key steps and introducing AI-driven Insta-Quote functionality, users could generate, customize, and submit loan terms in real time—reducing friction and speeding up decisions. The platform’s unified intake flow, tailored for both Bridge and Term products, streamlined collaboration across borrowers, loan officers, and relationship managers. These enhancements positioned Roc Capital competitively against leading players like Kiavi and RCN Capital, particularly in the highly active third-party loan originator market.

Increased loan submission speed and accuracy with AI-powered Insta-Quote and streamlined intake flows—allowing borrowers to receive quotes instantly instead of waiting days.

Enhanced user experience and engagement through a unified, intuitive platform tailored to different user types and optimized for both Bridge and Term products.

Improved market competitiveness against leaders like Kiavi and RCN Capital, with strengthened offerings for both third-party loan originators and direct-to-retail borrower experiences.

This project marked a significant step forward in unifying Roc Capital’s product experience, bringing consistency, clarity, and efficiency across all loan types. By streamlining workflows, introducing real-time AI-powered quotes, and tailoring the platform for both internal users and borrowers, One Quote successfully addressed long-standing pain points in the submission process. The improved UX, standardized language, and integrated communication channels created a cohesive and intuitive user journey. Ultimately, the project not only enhanced operational speed and accuracy but also positioned Roc Capital as a modern, competitive player in both the third-party originator and direct-to-borrower markets.