Comparison Analytics Tool

The Comparison Analytics Tool (CompTool) is a powerful platform designed to aggregate and analyze data from multiple sources—private, public, municipal, and internal datasets—to provide clear, concise, and actionable insights. It enables users to compare properties, loans, or financial data efficiently by presenting information in an organized and prioritized manner. Built with a familiar interface and seamless integration capabilities, the tool helps streamline decision-making, improve accuracy, and accelerate risk assessment and loan processing workflows. Ideal for underwriters, lenders, and real estate professionals, it transforms complex data into easy-to-understand comparisons that drive smarter, faster decisions.

Product Overview

Objective

Research, strategize, and design a comprehensive solution—starting with an MVP—to help underwriters assess and manage loan risk more efficiently, aiming to reduce loan processing time by 20%.

Problem Statement

Underwriting is central to any lender and delivering an accurate quote hinges on speed and efficiency.

Currently, underwriters rely on external tools like Redfin, HouseCanary, CoreLogic, and Zillow, which slows down their speed and efficiency. Meanwhile, our internal database—containing over 15 years of transaction data—remains underutilized.

Double Diamond Design Process

Using the Double Diamond Design Process is a four-phase framework that guides teams through problem-solving with a human-centered approach. It consists of two diamonds: the first focuses on understanding the problem through discovery and definition, while the second centers on solving it through development and delivery. By alternating between divergent thinking (exploring many possibilities) and convergent thinking (narrowing down to the best solution), the process ensures thorough research, clear problem definition, creative ideation, and effective implementation.

I proactively implemented this process without formally announcing it to participants, based on conversations with coworkers and my understanding of the company culture. There was a strong resistance to new processes, which many perceived as obstacles or disruptions to their existing workflows. By integrating the process subtly, I was able to gather valuable insights without triggering resistance or slowing down operations.

Discover & Define

Before building the product, it's essential to validate that a real problem exists and deeply understand the target users—their context, frustrations, needs, and pain points. This includes exploring how they currently address the problem, identifying the strengths and limitations of existing solutions, and uncovering their vision of an ideal experience. These insights ensure the product is grounded in real user needs and designed to deliver meaningful value.

During this phase was critical to shaping CompTool, ensuring it addressed real user needs and industry challenges. It included four key components: user interviews and surveys to gather both qualitative and quantitative insights, competitor analysis to identify market gaps, user personas to define target audiences, and the Jobs to Be Done framework to uncover users’ core goals and desired outcomes. Together, these elements provided a strong foundation for building a focused, user-driven product.

Surveys

We designed and conducted targeted surveys to gather both quantitative and qualitative feedback from users. This helped us validate assumptions, uncover user needs, and identify key pain points. The insights collected informed product decisions and helped prioritize features based on real user input at scale.

Designed targeted surveys to validate product assumptions and collect both quantitative and qualitative user feedback.

Key Takeways

Underwriters rely on multiple external, subscription-based products—such as Zillow, Redfin, and HouseCanary—to gather property data, creating a fragmented and often inefficient workflow.

Screenshots and data from external subscription-based products were manually collected, entered into spreadsheets, and then transferred into our platform—resulting in time-consuming workflows and increased risk of errors.

Underwriters faced intense pressure from upper management to accelerate the valuation process for both subject and target properties, often with limited tools and tight deadlines.

Identified key user needs and pain points to inform feature prioritization and product direction.

Key Takeways

There was a clear need for a streamlined approach to the valuation of subject and target properties to reduce manual effort, improve consistency, and meet the growing demand for faster turnaround times.

The platform needed to provide clear visibility for management across a team of 150+ underwriters, enabling better oversight, performance tracking, and resource allocation.

Used survey insights at scale to guide decision-making and ensure alignment with real user expectations.

Key Takeways

Exploration of AI and automation was essential to enable scalability and efficiency—reducing manual tasks, enhancing data accuracy, and supporting faster, more consistent decision-making.

Providing management and underwriters with a clear roadmap was crucial—outlining how processes would improve through streamlined workflows, integrated data, and automation, ultimately leading to faster valuations, reduced errors, and greater operational transparency.

User Personas

User personas for the Comparison Analytics Tool were developed to represent the key segments of our target audience, including underwriters, lenders, and real estate professionals. These personas were created based on insights gathered from interviews, surveys, and user research, and reflect the typical goals, behaviors, pain points, and workflows of our users.

Olivia – The Underwriter

Age: 38

Role: Senior Loan Underwriter

Goals: Minimize lending risk, ensure data accuracy, streamline evaluation process

Frustrations: Manual data collection from multiple sources, difficulty identifying risk factors quickly, time-consuming comparisons

Needs: A centralized, accurate view of loan and property data; automated risk indicators; clear comparison reports

Tech Comfort: Moderate – uses internal tools daily but prefers intuitive interfaces

Marcus – The Loan Officer

Age: 45

Role: Relationship Manager

Goals: Close deals quickly, assess borrower profiles efficiently, maintain compliance

Frustrations: Inconsistent borrower documentation, fragmented data sources, slow internal processes

Needs: Fast access to key financial metrics and borrower data; simplified, digestible comparisons; customizable reports for stakeholders

Tech Comfort: High – embraces tools that enhance productivity and reduce bottlenecks

Sarah – The Real Estate Executive

Age: 59

Role: Senior Executive

Goals: Oversee property portfolio performance, evaluate investment opportunities, and provide strategic insights for stakeholders

Frustrations: Lacks centralized visibility into data across MLS, public records, and internal systems; has limited insight into loan progress and underwriter performance; struggles with inconsistent formats and disconnected reports

Needs: A high-level, easy-to-use platform that consolidates data into clear dashboards and visual comparisons—without requiring technical expertise

Tech Comfort: Low – prefers intuitive, streamlined tools that deliver insights quickly without complexity

Competitor analysis

The competitor analysis for the Comparison Analytics Tool examined current platforms offering property comparison, financial analysis, and risk assessment, including traditional loan origination systems, real estate analytics tools, and data aggregators. Underwriters frequently juggle multiple solutions—such as Zillow, Redfin, HouseCanary, and internal spreadsheets—to compile and validate property data, resulting in inefficiencies, inconsistencies, and a high risk of manual error. This highlighted a significant market opportunity for CompTool: a single, integrated platform that unifies diverse data sources and delivers clear, side-by-side comparisons to enhance accuracy and streamline underwriting workflows.

Key Takeways

Most consumer-based products generally offer the same MLS data, with only slight variations in user experience and interface design, leading to minimal differentiation in functionality.

Investor- and industry-focused products like ATTOM, CoreLogic, HouseCanary, Estated, and others each offer unique features not found in the others, leading many underwriters to maintain multiple subscriptions across these platforms to meet all their needs.

Jobs to be Done

The Jobs to Be Done framework revealed that users—underwriters, lenders, and real estate professionals—need to efficiently evaluate, compare, and act on data to assess risk, validate property values, and make faster, more confident decisions. CompTool supports these jobs by streamlining workflows through automation, data consolidation, and intuitive analysis.

"When I’m evaluating a property, I want to quickly and confidently compare relevant data from a single source, so I can quickly make informed decisions and reduce risk with minimal effort."

Understand Circumstances

Underwriters often work under intense pressure to deliver accurate property valuations and loan assessments within tight deadlines.

They juggle multiple subscription-based, disconnected tools—such as Zillow, Redfin, HouseCanary, and others—to gather and verify property data.

Disconnected, non-standard processes increase the risk of errors, creates inconsistent experiences, delays in valuations, and lead to slower response times—frustrating both loan officers and borrowers.

Identify Hiring Criteria

A tool that consolidates multiple subscription-based data sources into a single platform while also eliminating redundant costs.

An easy-to-use interface that integrates seamlessly into existing workflows and our current platform, requiring minimal training.

Quick property valuations deliver actionable insights and automate comparison and analysis tasks, enabling faster, more informed decisions.

Define Success Criteria

Minimize time spent collecting and validating data across multiple sources by streamlining the entire process in one centralized platform.

Improve valuation response times from a week to just a few days while enhancing accuracy and confidence in comparisons and risk assessments.

Enable faster, smarter decisions by providing clear, side-by-side comparisons of key data—helping users quickly spot risks and opportunities with confidence.

Develop & Deliver

The delvelop and deliver for CompTool focused on creating a seamless, intuitive experience that supports underwriters and real estate professionals in making faster, more accurate decisions. It began with feature organization through Card Sort, ensuring priorities were clear and development was guided by user needs. User Journey Mapping helped define the structure and flow of the app, allowing for a logical arrangement of features and smooth navigation. Wireframes established the foundational layout, enabling early feedback and iterative refinement through usability testing. Finally, multiple rounds of User Testing helped validate the design, uncover pain points, and continuously improve the interface before moving into final development.

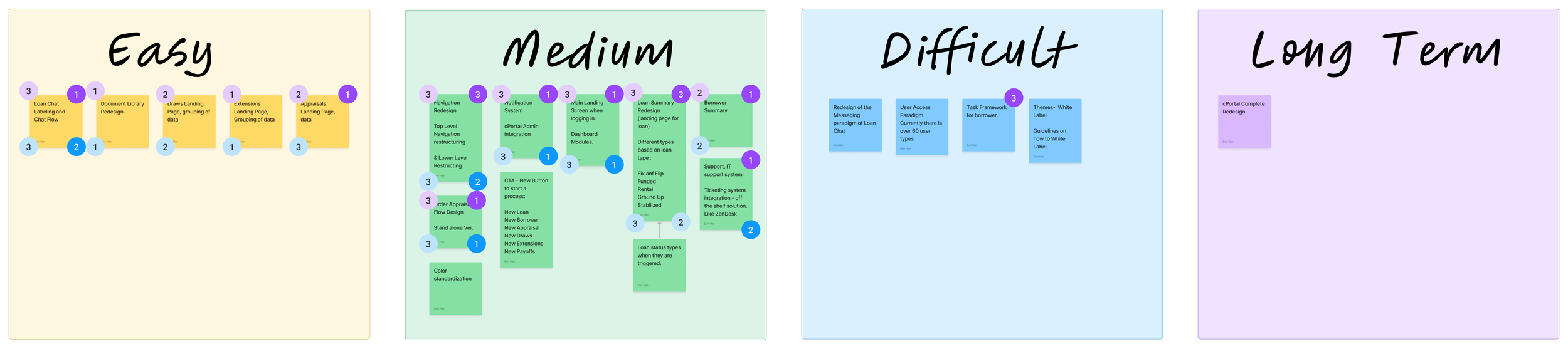

Feature Set (Card Sort)

Card Sort is a process where features are grouped into categories and ranked by importance once goals and tasks are clear. This helps prioritize development by identifying which features to build first and which can be added in later iterations.

Features are organized into categories based on their purpose and relevance, then ranked to prioritize development efforts, ensuring that the most important features are built first while others are scheduled for future updates.

Key Takeways

Maps is the top and most requested feature, offering the ability to geo-fence areas and display heat maps based on property performance data.

Data integration and the elimination of manual entry were highly requested features.

Accurate data sets were requested to improve ease of understanding and enhance risk management.

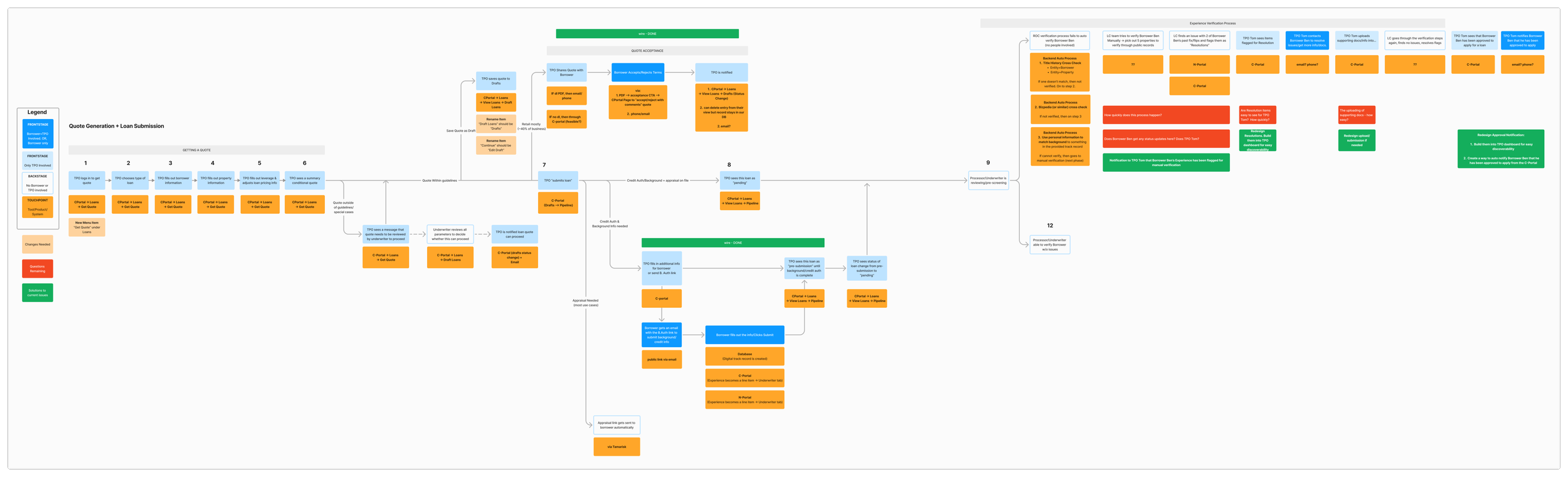

User Journey Map (flow)

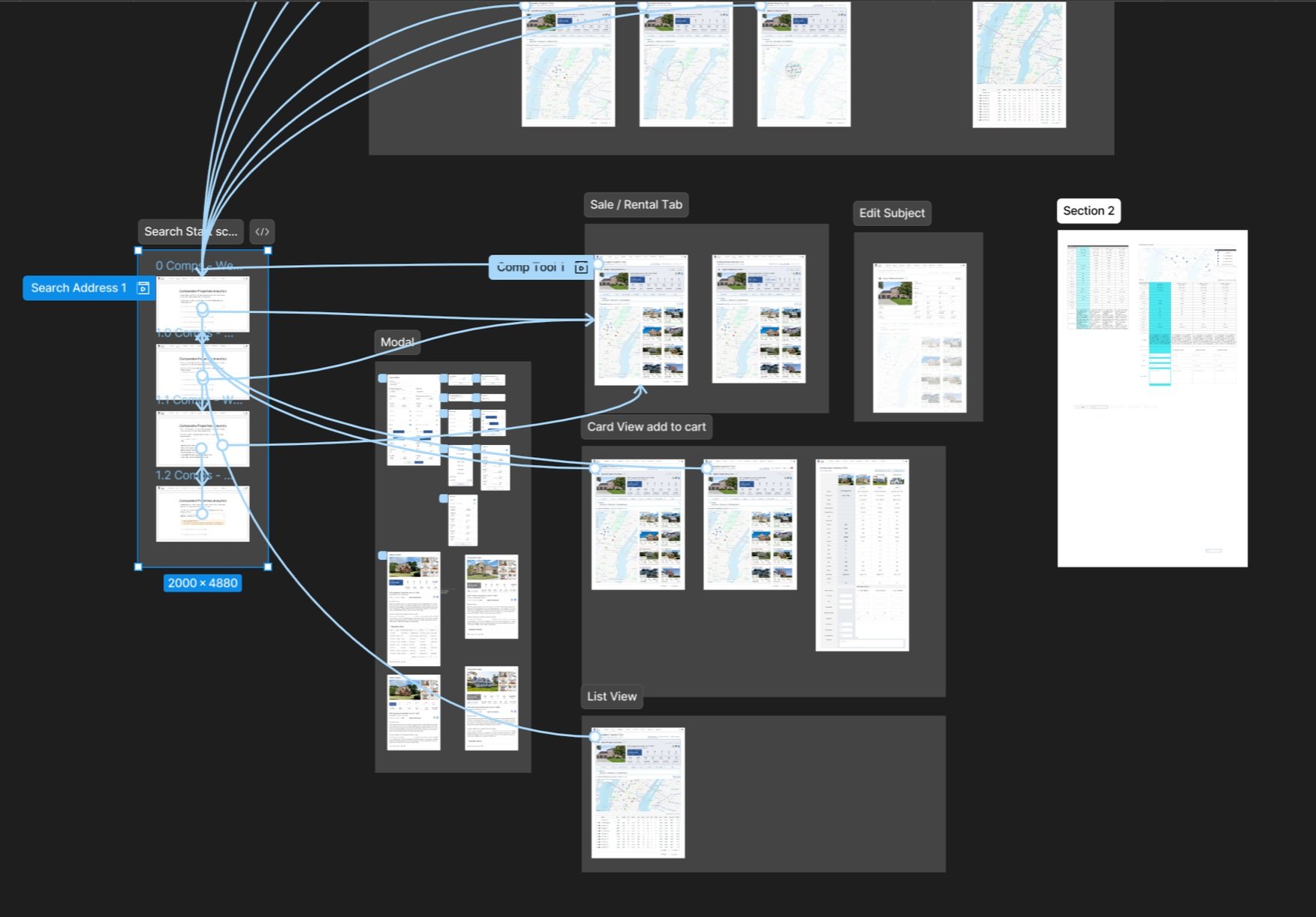

User Journey Mapping is an early ideation step that outlines the application’s workflow across different sections. It helps improve clarity for future development phases and remains adaptable as the design evolves.

The overall architecture and structure of the platform were defined by organizing features logically into distinct sections and establishing the hierarchy and priority of each section to ensure an optimal user flow.

Key Takeways

During the User Journey Mapping phase, the team uncovered how fragmented the current system is, with each underwriter approaching the process differently.

The project evolved from being just an analytical tool into a comprehensive solution that impacts the core processes of Roc 360.

By adopting a consolidated approach and designing journey maps for different phases, we enabled the product to be released in multiple, manageable cycles.

Concept Design

Before starting the design, guidelines were set to ensure white-labeling capabilities and a consistent visual identity aligned with Material Design principles. This approach ensured that the platform would not only be modern and user-friendly, but also easily customizable for different brands and clients.

However, because the development team wasn’t accustomed to working with a dedicated design team, we needed to gradually introduce this new collaborative process. This included creating shared documentation, holding regular cross-functional meetings, and aligning on workflows to bridge the gap between design and development. Over time, this transition helped foster stronger communication, smoother handoffs, and a more integrated approach to building the product.

Key Takeways

We need to simplify features and UX interactions because the developers’ current skill level isn’t quite where it needs to be yet, which will require time and investment to improve.

Leveraging existing or familiar frameworks helps the development team learn new concepts while delivering pixel-perfect product.

Implemented a fragmented Material Design approach initially while developing a roadmap for a brand-new, comprehensive global design system.

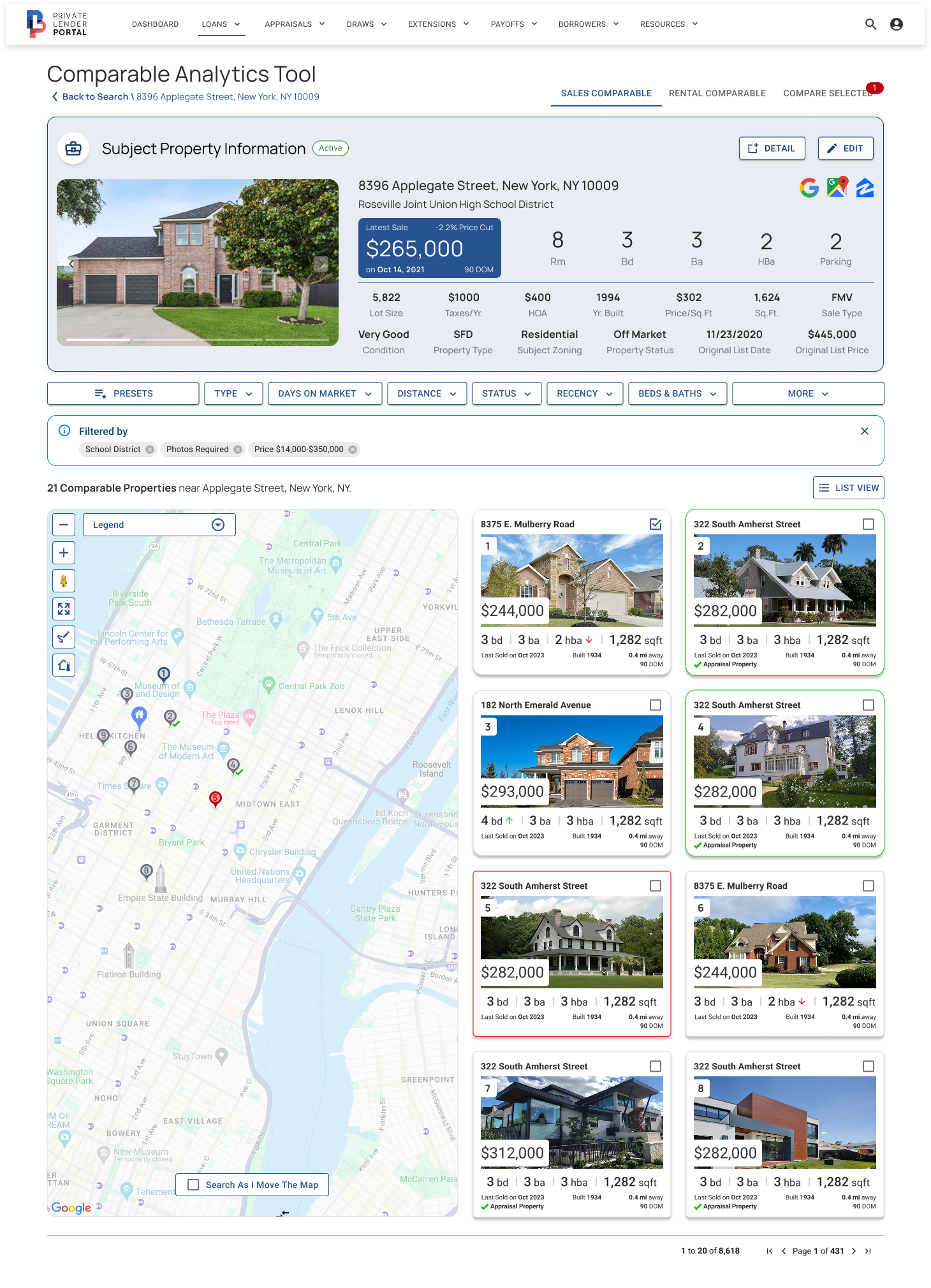

Prototyping

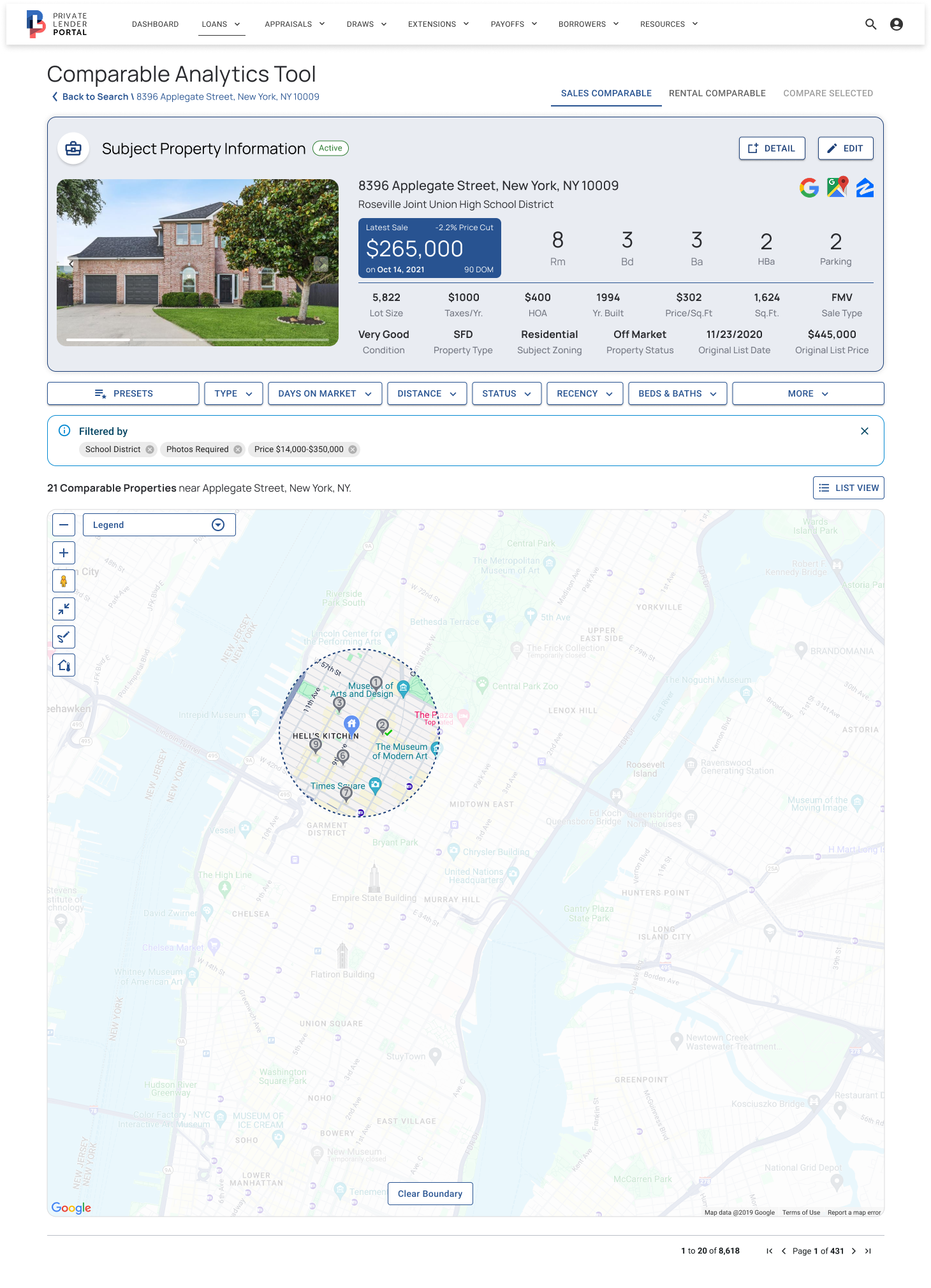

This 'Prototyping' section showcases the initial visual and structural framework of the platform, serving as a foundation for detailed design, user testing, and development planning. Since I was the sole designer on the project, I was able to address UX issues in real time—working through wireframing, prototyping, and visual design simultaneously. This integrated approach allowed for faster iteration, tighter alignment between functionality and design, and a more efficient path from concept to execution.

Key Takeways

Design was still a new concept at Roc360, and most team members weren’t familiar with interpreting wireframes effectively. As a result, I presented nearly finished prototypes to serve as test-bed wireframes, making it easier for stakeholders to understand and provide meaningful feedback.

During this phase, the discovery of hidden or broken processes within our core product was eye-opening for management, revealing critical gaps and opportunities for improvement.

With proper integration of a design system, both the prototyping and final design phases can move quickly and efficiently, ensuring consistency and reducing rework.

User Testing

As prototypes evolved, the workflow became increasingly clear, enabling ongoing refinement and resulting in a more polished version used to define multiple user journeys for testing. Through several rounds of usability testing, we gathered valuable feedback, identified pain points, and iterated on the design to improve the flow, reduce friction, and ultimately prepare the product for the final design phase.

Key Takeways

As a new process, it was challenging for participants unfamiliar with design workflows to fully understand what was happening, requiring some education and guidance to bring everyone up to speed.

Hidden requirements also surfaced during this phase, leading to instances of scope creep as new needs and expectations emerged from stakeholders.

Outcomes

The rollout of the Comparison Analytics Tool MVP resulted in significantly faster and more accurate property and loan assessments by consolidating multiple data sources into a single, easy-to-use platform.

Consolidated multiple subscription-based data sources into a single in-house platform, reducing manual effort and cutting costs for over 150+ underwriters.

Reduced valuation response times from 6–7 days to just a few hours while significantly improving accuracy.

Streamlined workflows and enabled faster, more confident decision-making through automated insights and clear comparisons.

From this project, we not only defined a future roadmap featuring a retail subscription-based model for CompTool but also identified several additional initiatives that will enhance Roc Capital’s core business. These include projects such as One Quote, a task management framework, a design system, and a mobile app designed for loan originators and borrowers.

The Double Diamond process proved highly successful, guiding the team through focused discovery and definition phases, fostering alignment across departments, and enabling effective ideation and delivery with clear, validated outcomes.