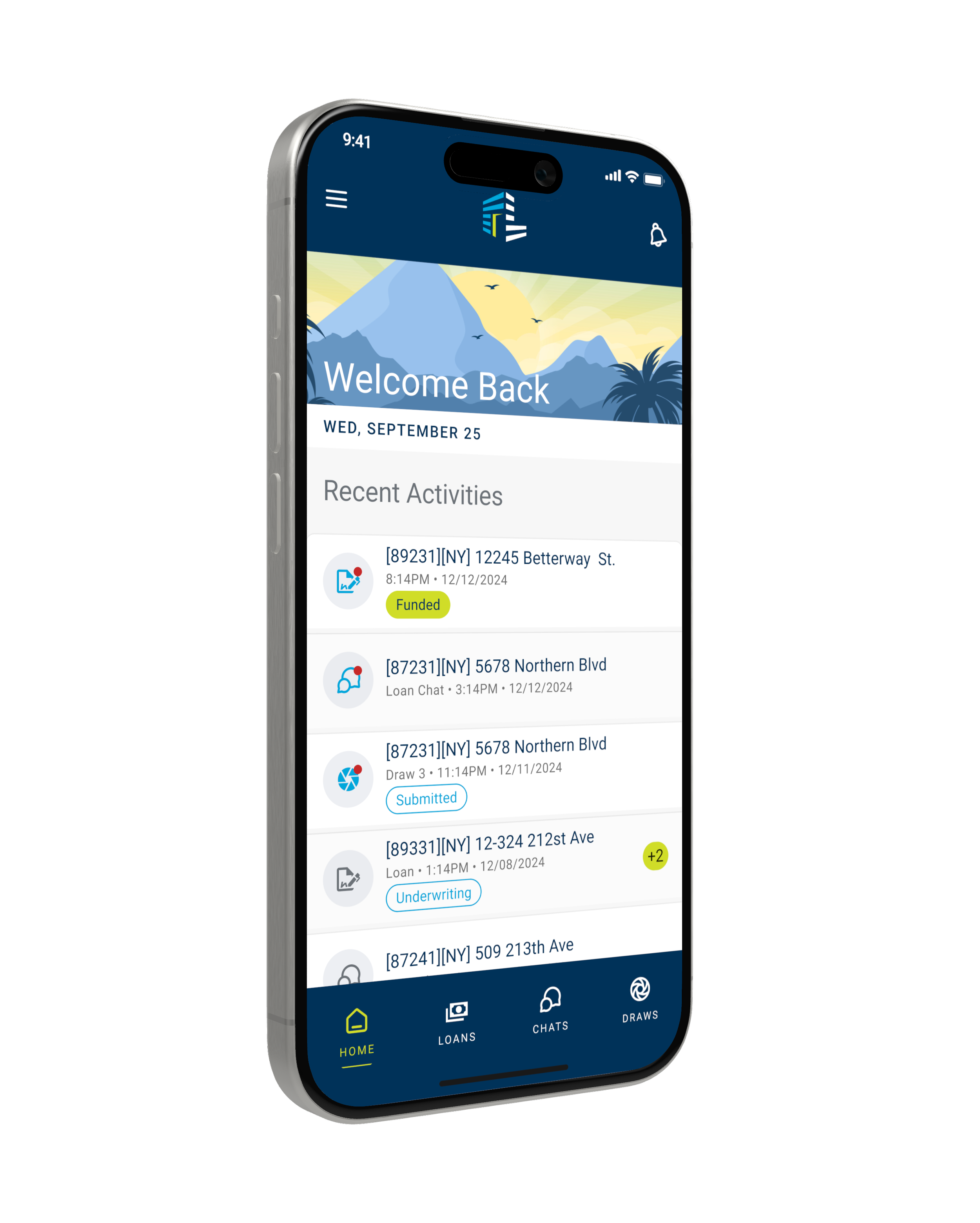

“White Labeled” Mobile App

This mobile app was conceived and presented as an extension of the white-labeled borrower and originator portal, designed to enhance accessibility, boost user engagement, and offer greater flexibility across devices. It brings the core functionalities of the desktop portal into a streamlined, intuitive mobile experience—purpose-built for users who need access on the go.

Product Overview

Objective

Design and deliver a mobile application that extends the core functionalities of the white-labeled borrower and originator portal, enabling seamless, on-the-go access. The MVP will focus on high-impact features, with an initial emphasis on Draws request and validation workflows—one of the most critical and time-sensitive user needs. The app will prioritize ease of use, performance, and responsiveness across devices to directly address the top user request. Success will be measured by achieving a borrower user adoption rate of at least 20% within the first six months post-launch.

Problem Statement

Borrowers and loan originators increasingly require access to critical loan functions and information while away from their desktops. User research and feedback consistently identified a mobile solution as the most requested feature. The existing white-labeled portal, while robust, lacks mobile optimization—limiting flexibility, delaying submissions, and hindering user engagement and satisfaction. A mobile app is essential to meet user expectations, improve efficiency, and drive platform adoption.

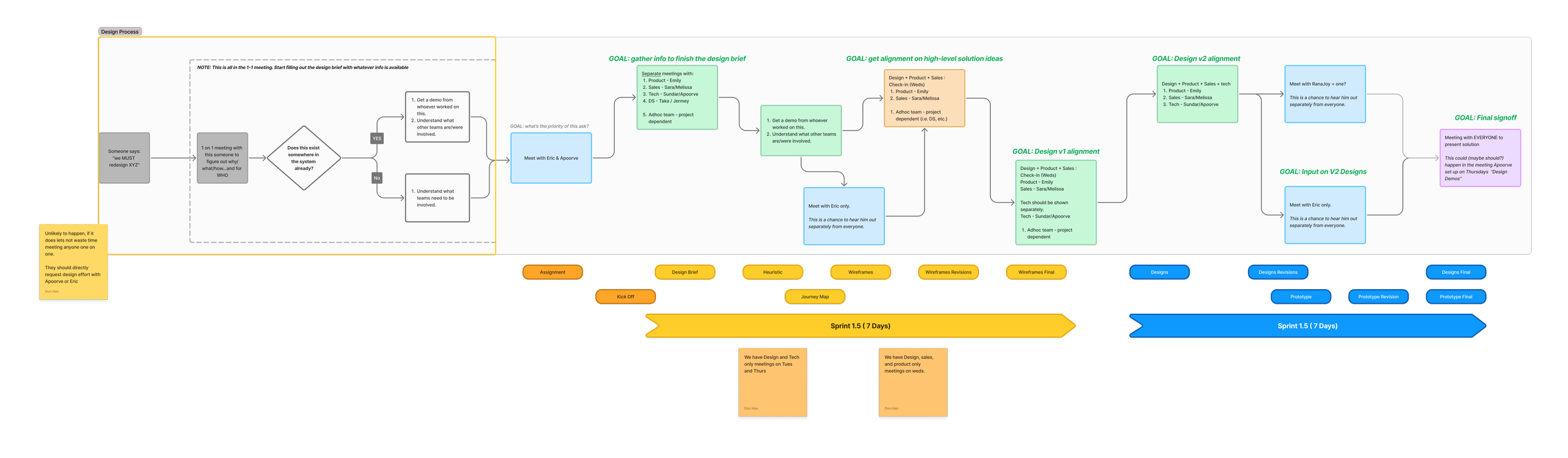

Double Diamond Design Process

The Double Diamond is a four-phase, human-centered design framework that moves from identifying the right problem to delivering the right solution. It consists of two key stages: the first diamond focuses on discovery and definition—diverging to explore the problem space, then converging to clearly define it. The second diamond shifts to development and delivery—generating a range of solutions before refining and implementing the most effective one.

Recognizing resistance to formalized processes within the company, I adopted the Double Diamond framework informally. Through organic conversations and cultural observation, I embedded its principles into our workflows without explicitly labeling them. This subtle integration allowed us to uncover user insights, align on problem definitions, and iterate on solutions—without disrupting team dynamics or triggering pushback.

Discover & Define

Before building a mobile app, it’s crucial to validate the idea by confirming a real problem exists. Equally important is developing a deep understanding of the target users—their environment, frustrations, needs, and pain points—especially in the context of mobile usage. We must explore how they currently address the problem on mobile (or if they do at all), and assess the strengths and limitations of those existing solutions. Finally, understanding their vision of an ideal mobile experience helps shape an app that truly aligns with their expectations and solves their challenges effectively.

To validate the need for a mobile application and guide its design, we conducted a combination of surveys, user interviews, and competitor analysis. Surveys helped us capture broad quantitative insights on mobile usage habits, pain points, and feature priorities across borrower and originator groups. In-depth user interviews uncovered contextual behaviors, unmet needs, and frustrations with the current desktop-dependent workflow—particularly around time-sensitive draw requests. From this research, we developed detailed user personas representing key segments, highlighting their goals, technical comfort levels, and mobile contexts (e.g., on-site inspections, remote approvals). We also performed a competitor analysis to benchmark mobile capabilities in similar financial tools, identifying gaps and opportunities for differentiation. Applying the Jobs to Be Done framework, we reframed user needs not just as features, but as desired outcomes—for example, “Quickly submit a draw request while on a job site without delays or errors.” These insights grounded our product strategy in real-world use cases, ensuring the MVP would deliver practical, high-impact value from day one.

Surveys

The survey targeted both borrowers and loan originators to understand their mobile behaviors, challenges, and expectations regarding loan management. Results showed that over 70% of respondents regularly needed access to loan tools while away from a desktop, with a majority relying on clunky workarounds like emailing documents to themselves, calling relationship managers for status updates, or using desktop portals in mobile browsers—often leading to frustration and delays. Borrowers expressed pain around not being able to submit draw requests or upload supporting documents while on-site, causing payment delays. Loan originators reported difficulty tracking borrower progress, managing document validation, and responding quickly to urgent tasks without a mobile-native solution. Both groups emphasized the lack of responsiveness and poor usability of the current portal on mobile devices. These pain points reinforced the demand for a purpose-built mobile app that simplifies core workflows, reduces friction, and enables fast, reliable interactions from anywhere.

Designed targeted surveys to validate product assumptions and collect both quantitative and qualitative user feedback.

Key Takeways

Validated user demand for a mobile app, with over 90% of respondents indicating a strong need for on-the-go access to loan functions.

Identified key pain points, including difficulty submitting draw requests, uploading documents, checking loan status, and completing loan submissions via mobile.

Uncovered workflow inefficiencies, revealing that users often resort to workarounds like calling relationship managers or using non-optimized browser views, leading to delays and frustration.

Identified key user needs and pain points to inform feature prioritization and product direction.

Key Takeways

Confirmed strong mobile demand, with 90%+ of users needing mobile access to manage loans, especially for time-sensitive tasks.

Exposed high-friction mobile workflows, including submitting draw requests, completing loan submissions, and uploading documents—often handled through inefficient workarounds like calling support or using non-optimized browser views—underscoring the need for a dedicated mobile app.

Used survey insights at scale to guide decision-making and ensure alignment with real user expectations.

Key Takeways

Prioritized high-impact features—like draw requests, loan submissions, and document uploads—based on frequency and urgency reported by users.

Validated MVP scope by aligning core functionality with the most common mobile use cases and pain points identified in the survey.

Created a user-informed roadmap by balancing survey-driven priorities with technical feasibility and business goals—ensuring the MVP focused on speed, simplicity, and the most critical mobile workflows.

User Personas

Based on survey insights, we developed three core user personas to guide design decisions: the First-Time Borrower, who needs a simple, guided experience with mobile access to track progress and upload documents; the Repeat Borrower, a tech-savvy user focused on speed and efficiency, often working from the field and requiring quick access to draw submissions and status updates; and the Loan Originator, who juggles multiple clients and needs real-time visibility into borrower activity, mobile-friendly tools for validation, and the ability to keep deals moving on the go. These personas ensured our roadmap and UX were grounded in real user behaviors, goals, and pain points.

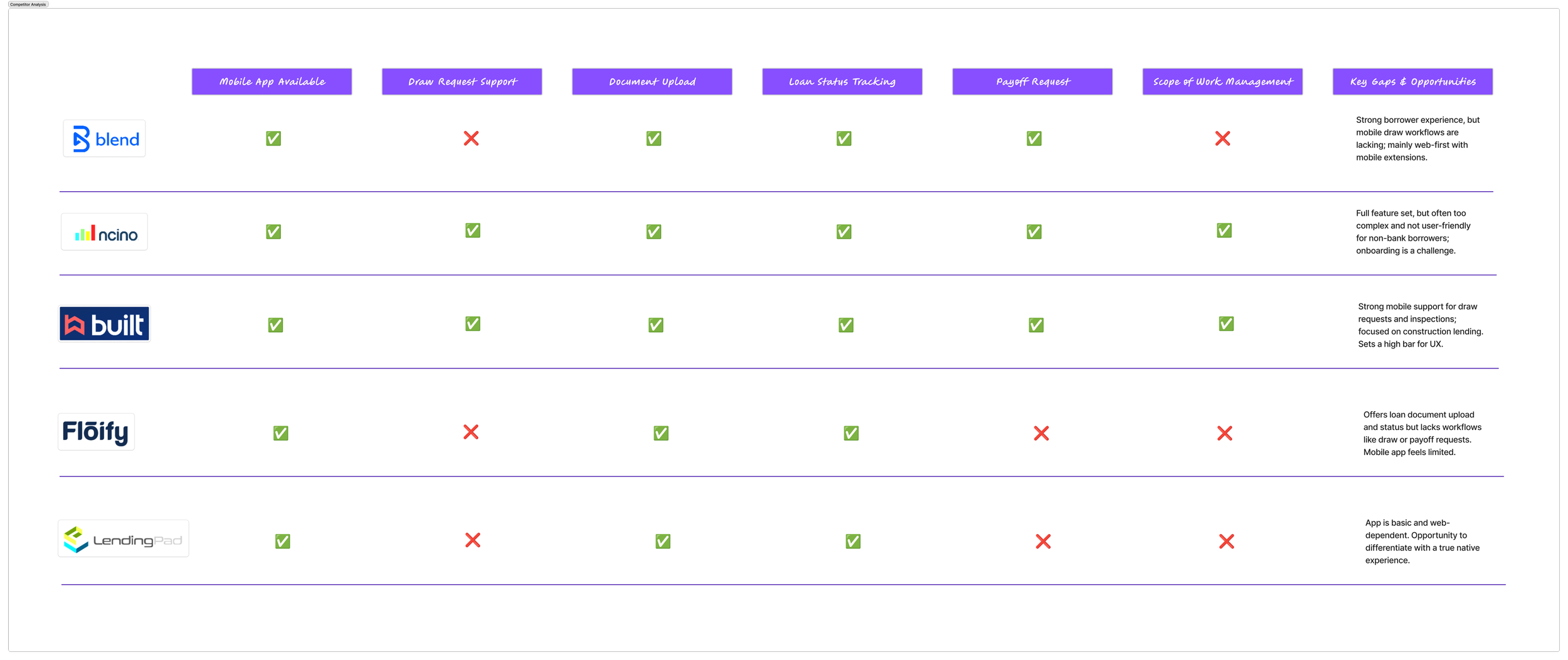

Competitor analysis

The competitor analysis for the Comparison Analytics Tool examined current platforms offering property comparison, financial analysis, and risk assessment, including traditional loan origination systems, real estate analytics tools, and data aggregators. Underwriters frequently juggle multiple solutions—such as Zillow, Redfin, HouseCanary, and internal spreadsheets—to compile and validate property data, resulting in inefficiencies, inconsistencies, and a high risk of manual error. This highlighted a significant market opportunity for CompTool: a single, integrated platform that unifies diverse data sources and delivers clear, side-by-side comparisons to enhance accuracy and streamline underwriting workflows.

Key Takeways

Market Gap in Mobile Draw Requests: Only Built Technologies offers robust, native mobile support for draw workflows. Others either lack the feature or relegate it to desktop. Huge opportunity for differentiation.

Usability Over Complexity: nCino and ICE offer powerful tools, but complexity limits borrower adoption. A lightweight, borrower-friendly mobile app focused on 2–3 core use cases will be a strong differentiator.

Scope of Work Gaps: Few competitors support these mobile-first. Including them in your MVP will help meet unmet user needs—especially for on-the-go stakeholders.

Jobs to be Done

The mobile app is designed to address borrowers’ and loan originators’ core job-to-be-done: “When I’m away from my desk, I want to manage critical loan tasks from my phone, so I can keep projects moving without delays or disruption.” Whether it's submitting a draw request on-site, uploading documents in real time, checking loan status, or initiating a payoff request, users need fast, reliable access to high-impact workflows from anywhere. By focusing on these real-world jobs—rather than just replicating desktop features—the app delivers tangible value, improves efficiency, and meets users in the moments that matter most.

Understand Circumstances

When I’m at a construction site and need to request funds for completed work, I want to submit a draw with supporting photos directly from my phone, so I can avoid payment delays and keep the project moving on schedule.

When a client calls me to ask or client can check about the status of their loan or draw, I want to quickly check the current status on my mobile device, so I can respond confidently and maintain their trust.

When I’m away from my office and receive important loan documents, I want to upload them immediately from my phone, so I can stay compliant and avoid missing deadlines.

Identify Hiring Criteria

Enables fast and easy completion of critical loan tasks from anywhere through simplicity and speedy workflows.

Reduces delays, errors, and manual effort in submitting draws and documents through AI automation and OCR processes.

Provides real-time visibility and confidence in loan progress and status, building user trust through a seamless white-labeled experience.

Define Success Criteria

User Adoption Rate: Achieve a borrower mobile user adoption of at least 20% within the first six months post-launch, indicating strong demand and usability.

Task Completion Efficiency: Reduce the average time it takes users to submit draw requests, upload documents, and check loan status compared to the desktop portal.

User Satisfaction & Feedback: Attain high satisfaction scores and positive feedback from borrowers and originators, demonstrating that the app effectively meets their needs and improves workflows.

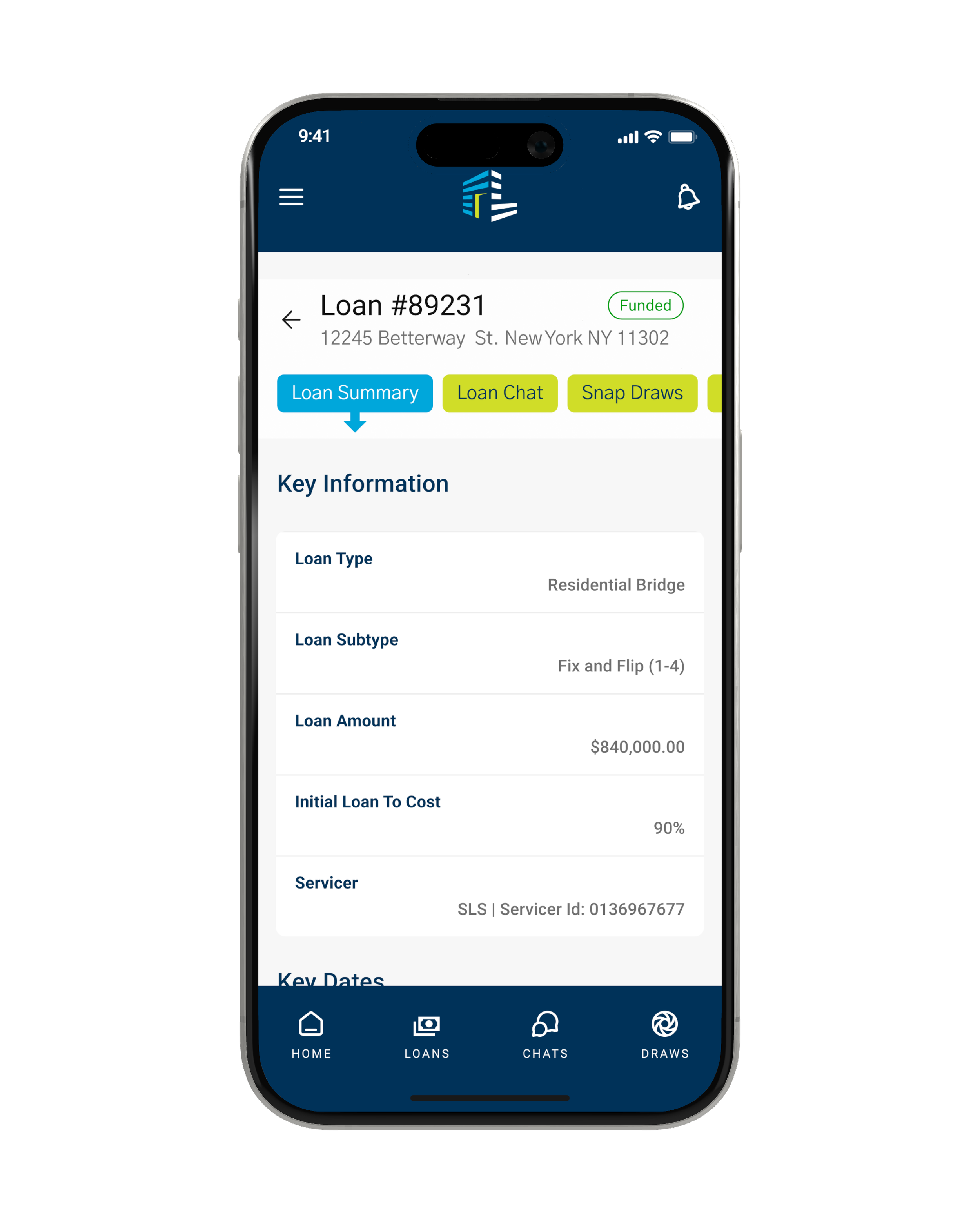

Develop & Deliver

In the Develop & Deliver phase of the Double Diamond, the focus shifts from exploring solutions to building and refining the mobile app to meet validated user needs. Based on insights gathered during discovery, the development team creates prototypes and iterates rapidly, prioritizing core workflows such as draw requests, document uploads with OCR, and loan status tracking. User feedback is continuously incorporated through testing to ensure the app is intuitive, performant, and reliable across devices. The delivery includes thorough quality assurance and staged rollouts to manage adoption and gather real-world usage data. This phase ensures that the final product not only solves the right problems but also provides a seamless, high-impact mobile experience that drives user engagement and platform adoption.

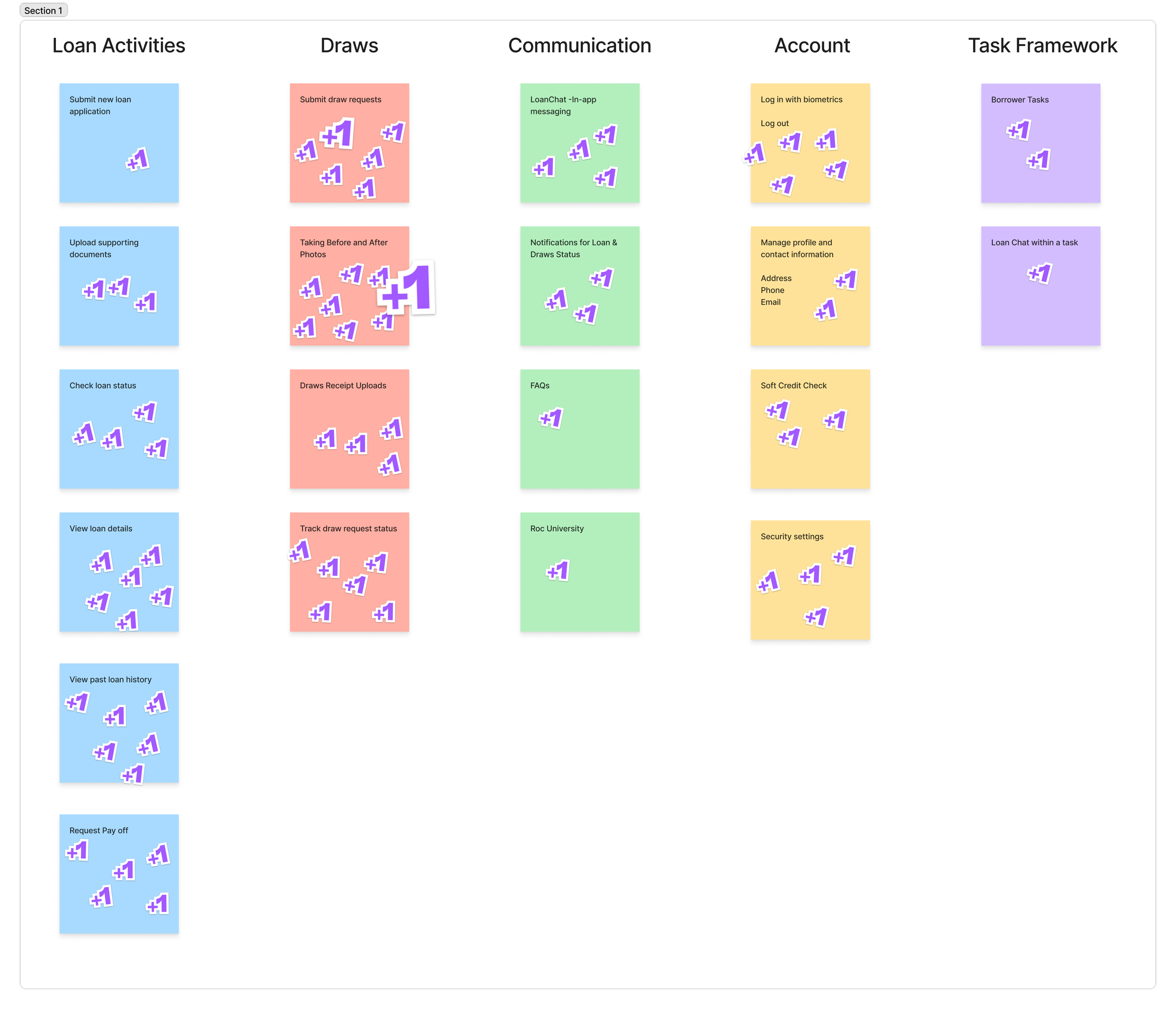

Feature Set (Card Sort)

Card sorting is a user-centered research method used to organize and prioritize features based on how real users think about and categorize them. By engaging borrowers and loan originators in card sorting exercises, we gained valuable insights into their mental models, which helped shape an intuitive information architecture for the mobile app. This process clarified which features—such as draw requests, document uploads, loan status checks, and payoff requests—were most important and how users expect to navigate between them. The results informed a streamlined feature set focused on simplicity and ease of use, ensuring that the app’s design aligns closely with user expectations and supports efficient workflows on mobile devices.

Card sorting reveals how users naturally group and prioritize features, guiding intuitive navigation and helping identify the most critical elements—like draw requests and document uploads—for the MVP.

Key Take Aways

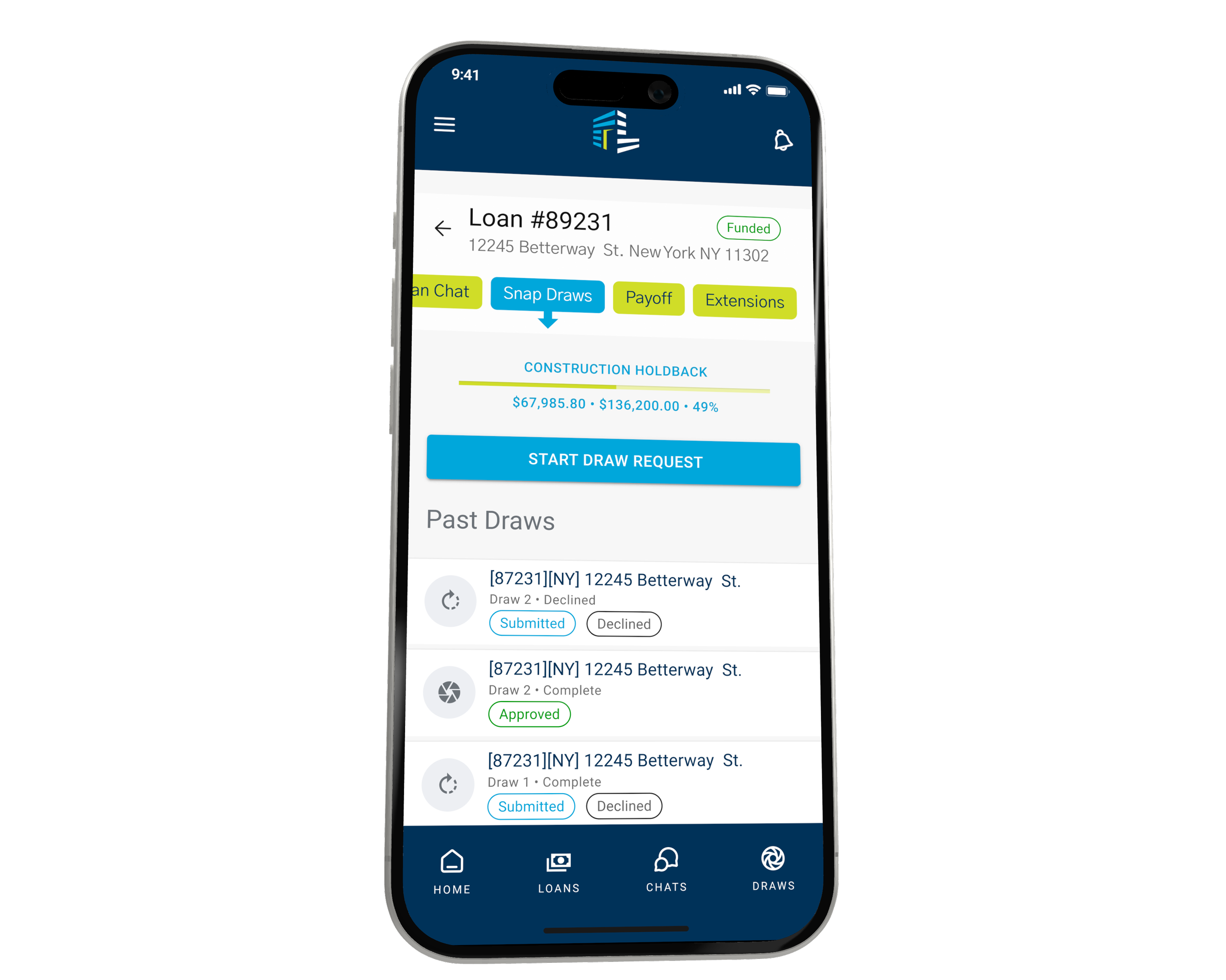

Snap Draw Requests: Retaining our Snap Draw branding, this feature uses AI-powered algorithms to enable fast, accurate submission of draw requests from the field—streamlining approvals, reducing delays, and improving cash flow with minimal manual effort.

Document Upload with AI & Automation: Simplifies and accelerates documentation by using OCR and AI to auto-extract data, minimize errors, and reduce manual input.

Loan Status Tracking: Provides real-time visibility into loan and draw progress, enhanced by integrated Loan Chat for instant communication—ensuring transparency, faster resolutions, and confident decision-making throughout the loan lifecycle.

It ensures the app’s structure aligns with user expectations, improving usability, streamlining workflows, and boosting overall adoption.

Key Take Aways

Improved Usability: By doubling down on simplified UX while maintaining a seamless white-labeled experience, the app delivers intuitive navigation that reflects user mental models—making it easier to complete tasks efficiently and confidently.

Streamlined Workflows: Leveraging AI to reduce friction and enhance communication, the app prioritizes high-impact features—enabling faster task completion, smarter automation, and more seamless user interactions.

Higher Adoption: A user-aligned structure, combined with a clear onboarding process and a seamless white-labeled experience, builds trust and satisfaction—driving broader, faster, and sustained mobile app engagement.

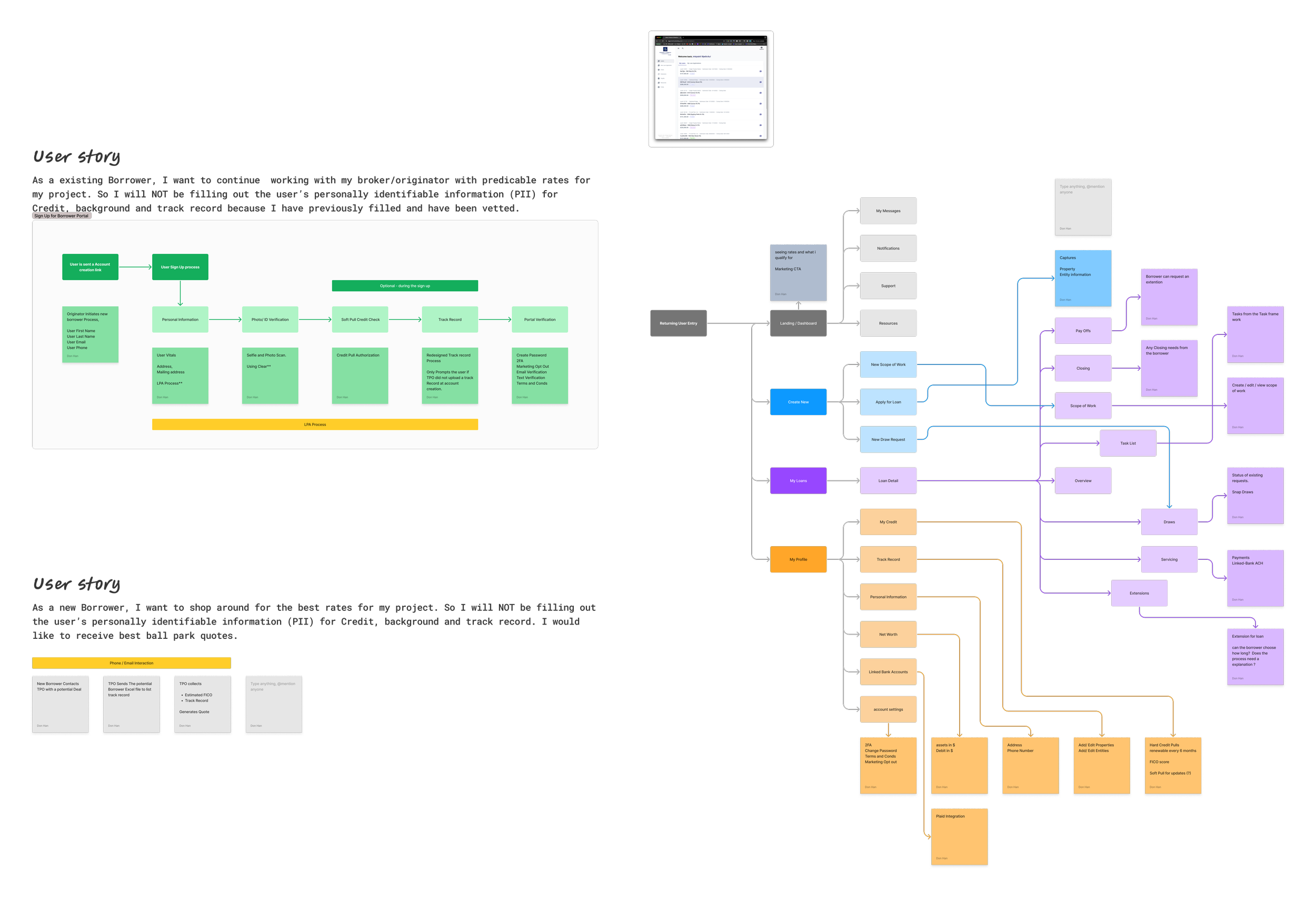

User Journey Map (flow)

A User Journey Map for the mobile app outlines the end-to-end experience of borrowers and originators as they interact with key features like Snap Draw requests, document uploads with AI automation, and real-time loan status tracking. It captures each stage—from initial onboarding to task completion—highlighting user goals, emotions, pain points, and touchpoints across mobile workflows. By mapping the journey, we identified friction points such as delayed draw approvals, repetitive data entry, and lack of timely updates. This insight guided design decisions that simplified navigation, introduced intelligent automation, and integrated real-time communication through Loan Chat. The result is a streamlined, white-labeled experience that meets users where they are—on the go, under pressure, and expecting speed, clarity, and control.

Identifies Pain Points: Highlights friction areas like delayed draw approvals and repetitive manual input, guiding targeted design improvements.

Key Take Aways

Reduced Friction Through AI-Powered Workflows: User journey mapping revealed key pain points—like delayed draw approvals and manual input—which were addressed through AI automation, smart OCR, and streamlined workflows.

Boosted Adoption with User-Centered Design: Insights shaped a white-labeled experience with clear onboarding and real-time communication, increasing user confidence, efficiency, and long-term engagement.

Improves Feature Flow: Informs a seamless experience by aligning key touchpoints—such as Snap Draw, document upload, and loan status—with user expectations.

Key Take Aways

Aligned Touchpoints with User Needs: The journey map ensured features like Snap Draw, document upload, loan status, and real-time communication via Loan Chat were placed where users naturally expect them—enabling a smoother experience.

Enhanced Workflow Efficiency: Streamlining feature flow—combined with AI automation, and instant notifications —reduced unnecessary steps and cognitive load, making critical loan tasks faster, more intuitive, and highly responsive on mobile.

Enhances Engagement: Supports a clear, white-labeled onboarding and integrates real-time communication via Loan Chat to boost confidence and retention.

Key Take Aways

Strengthens Brand Trust and Adoption: A seamless white-labeled interface paired with clear, guided onboarding builds user confidence, reinforces brand identity, and accelerates app adoption.

Drives Retention with Real-Time Communication: Integrated Loan Chat and instant notifications keep users informed and supported, strengthening long-term engagement.

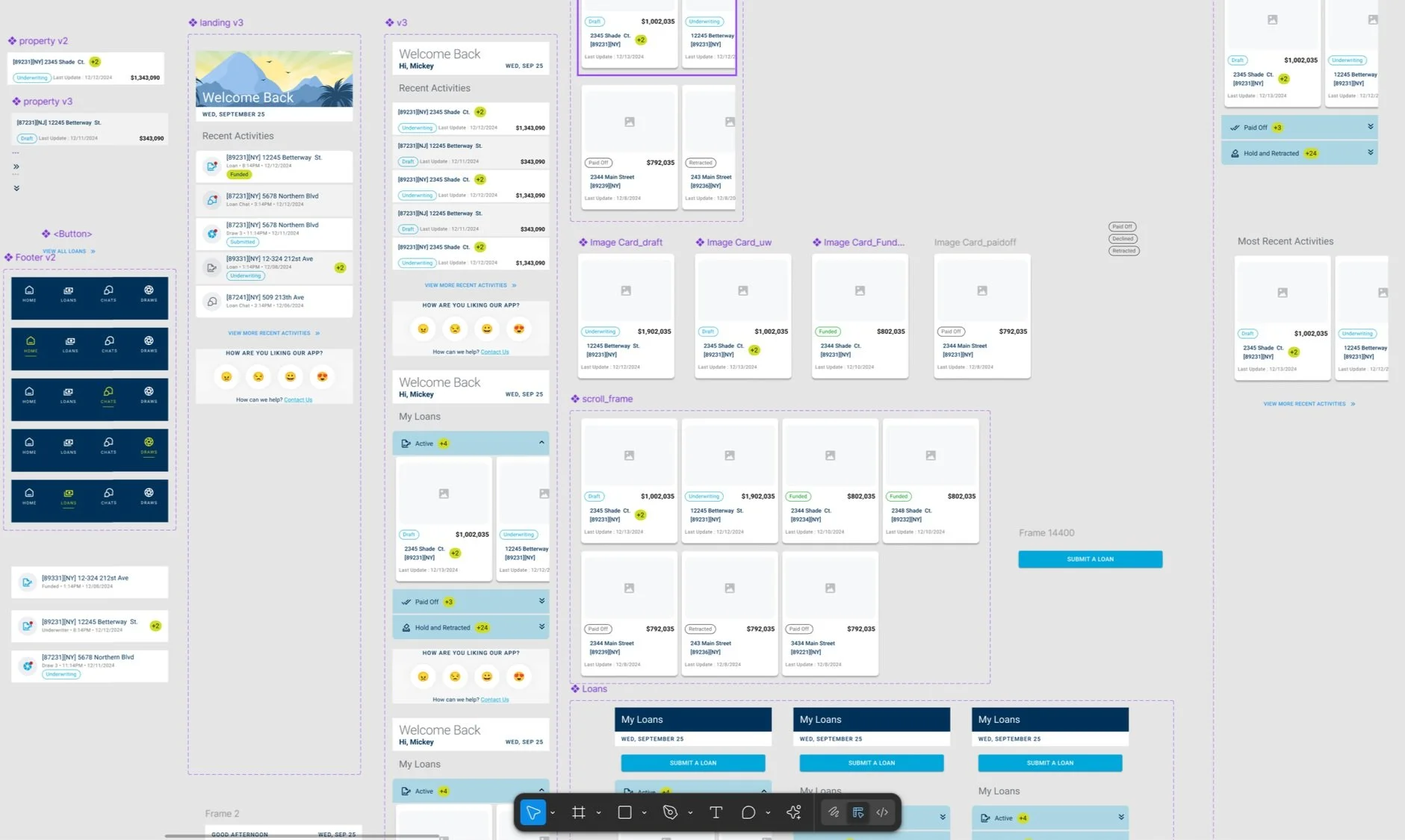

Concept Design

The concept design phase focused on translating user insights into a clear, purpose-driven vision for the mobile experience. Centered around high-impact workflows like Snap Draw requests, AI-powered document uploads, and real-time loan status tracking, the design prioritized simplicity, speed, and mobile-native usability. We explored multiple layout and interaction models to ensure the app felt intuitive and accessible—especially for users in fast-paced, on-the-go environments. Maintaining a white-labeled look and feel was critical to reinforcing client brand identity, while a thoughtfully designed onboarding flow ensured a smooth entry point for new users. The result was a cohesive, scalable design concept aligned with real-world needs and ready for iterative development.

Key Takeways

User-Centered Simplicity: Design prioritized ease of use for mobile users in field environments, focusing on core tasks like Snap Draw, document uploads, and loan tracking.

Brand-Consistent Experience: Leveraging the Roc360 Global Design System, the concept ensured a fully white-labeled, cohesive interface that aligned with client branding and elevated user trust across the mobile experience.

Smooth Onboarding Flow: Leveraging my extensive experience with fintech onboarding, the design incorporates a clear, guided onboarding process that accelerates user adoption and minimizes learning curves.

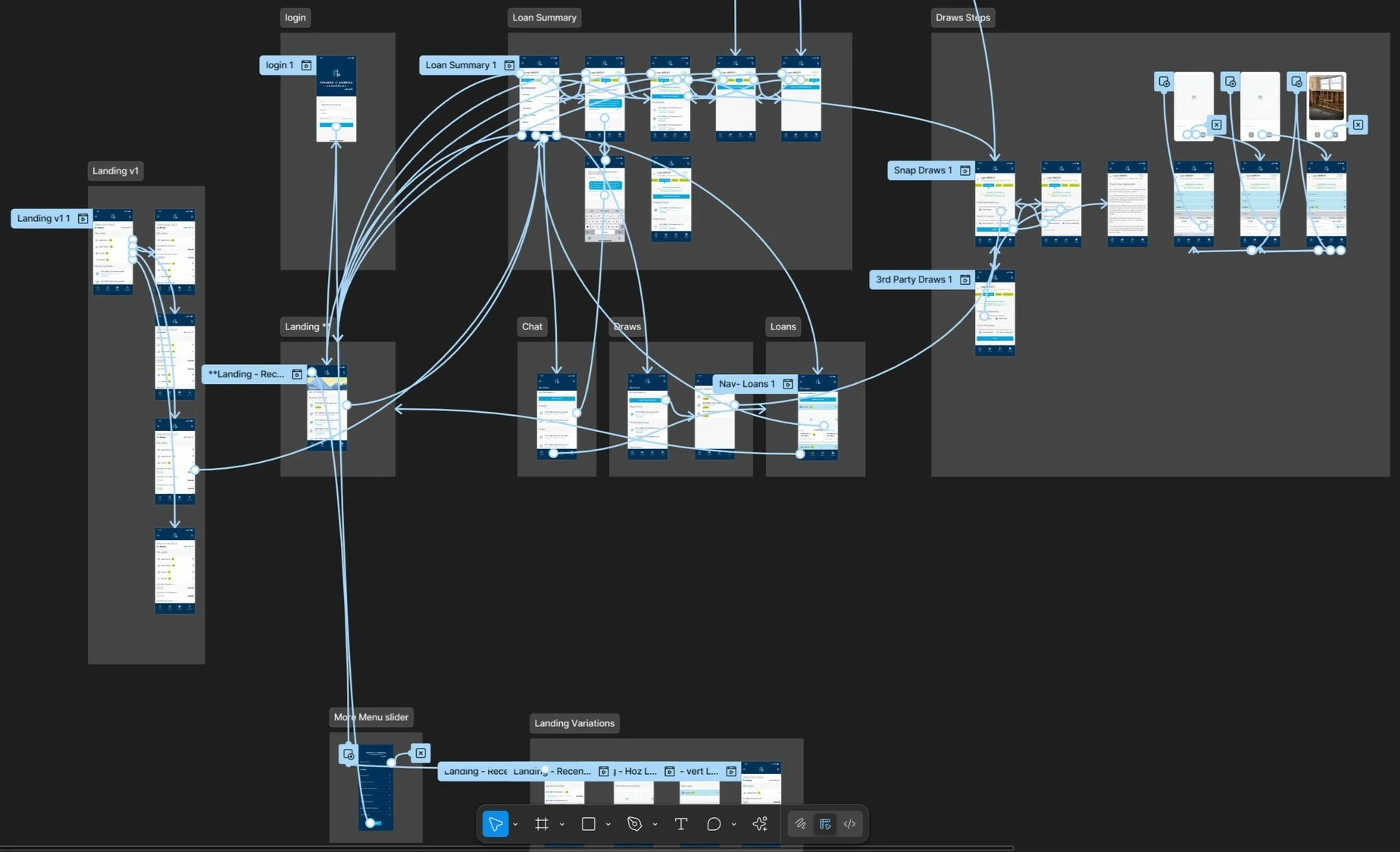

Prototyping

The prototyping phase translated concept designs into interactive, testable models that brought key mobile workflows to life. Using rapid iteration, we developed low- to high-fidelity prototypes focused on critical features such as Snap Draw requests, AI-driven document uploads, and loan status tracking. These prototypes allowed users to engage with realistic scenarios, providing valuable feedback on usability, navigation, and overall experience. Incorporating this input helped refine interactions, improve UI clarity, and validate the app’s performance expectations across devices. The iterative prototyping approach ensured that the final development aligned closely with user needs, reduced risks, and set a strong foundation for a smooth rollout.

Key Takeways

User Feedback Integration: Early prototyping and continuous testing drove iterative improvements that enhanced usability, accelerating user adoption and building loan originator trust through a seamless white-labeled experience.

Validated Core Workflows: Interactive prototypes confirmed that essential features—document uploads, AI-powered workflows, and instant notifications—effectively met user needs, enhancing efficiency and responsiveness in the mobile app.

Mapped out a roadmap for several releases, enabling incremental delivery and continuous refinement based on user feedback and prototyping insights to reduce development risk and ensure a smooth final rollout.

Outcomes

The limited Beta MVP testing yielded strong results, validating both the Snap Draw functionality and the AI-powered document automation process. Borrowers were able to submit draw requests directly from the field with minimal friction, significantly reducing turnaround time compared to the desktop workflow. The AI-driven document upload, leveraging OCR and auto-tagging, successfully extracted key information with over 90% accuracy, minimizing manual data entry and errors. Feedback from participants indicated high satisfaction with the app’s speed, ease of use, and mobile responsiveness. The test also reinforced the value of instant notifications and real-time updates, with users reporting increased confidence in the platform. Overall, the beta proved the concept’s viability, confirming user demand and laying a strong foundation for broader rollout.

Streamlined Draw Submissions: Snap Draw enabled borrowers to easily capture and submit before-and-after photos from the field, while AI validated image content and quality—reducing friction, improving submission accuracy, and cutting the draw approval process from a few days to just a few hours.

High Accuracy with AI Automation: OCR-powered document uploads, combined with intelligent AI workflows and clear in-app notifications, reduced manual entry, improved processing speed, and kept users informed at every step—driving greater efficiency and trust in the system.

Positive User Reception: Users reported high satisfaction with the mobile experience, praising its simplicity, responsiveness, and use of familiar fintech-related terms. Real-time notifications and clear communication further boosted confidence, making the platform feel intuitive and reliable from day one.

This mobile app initiative marked a major step forward in modernizing Roc Capital’s borrower and originator experience, delivering a unified, intuitive platform optimized for mobile workflows. Through a limited MVP launch, the app successfully validated high-impact features like Snap Draw submissions, AI-powered document uploads, and real-time status updates. By simplifying complex processes, using fintech-standard language, and integrating clear communication channels and instant notifications, the app addressed long-standing pain points in field-based loan management. The result was a faster, more accurate, and more user-friendly experience that boosted borrower confidence and operational efficiency—positioning Roc Capital as a forward-thinking leader in mobile-first lending solutions.